Does the HM Land Registry Accept Electronic Signatures?

Luke Garrett

Director of Product

PUBLISHED

5th August, 2025

Contents

With customers increasingly asking if they accept electronic signatures and the very real need for effective digitalisation, the HM Land Registry consulted with regulators, trade bodies, conveyancers, lenders, estate agents and providers like E-Sign, to address the viability of digitalising property transactions and the security of electronic signatures.

What is the HM Land Registry stance on eSignatures?

In 2020, the HM Land Registry began accepting electronic signature technology, including third party electronic witnessing. Since then, they have been evaluating various types of electronic signatures.

Practice Guide 82 was released in 2022, which includes guidance and information on the types of signatures accepted by the HM Land Registry. Specifically, it covers:

- Mercury signatures: Digital signatures used in virtual signings or closings.

- Conveyancer-certified signatures: Signatures certified by a conveyancer as meeting the requirements of the guide.

- Mixed signing: Combining different types of signatures.

- Other electronic signatures: Includes qualified signatures.

In August 2025, after completing a pilot, the HM Land Registry announced that it would now be accepting qualified electronic signatures (QES). This is the most secure form of electronic signature and uses a technology called a ‘digital certificate’ to authenticate the signer’s identity. Digital certificates show that signers have completed extra steps to verify their identity.

As an accredited UK government supplier and registered ICO data processor, E-Sign were proud to advise and guide the HM Land Registry during their assessment of electronic signatures and the challenges of security and identity verification.

The Legality of Electronic Signatures in Property Transactions

Electronic signatures have been legally acceptable in the UK since 2000, with the introduction of the Electronic Communications Act 2000. Electronic signatures have also been eIDAS compliant since 2016, aligning the UK with EU electronic signature standards. Further to this, the Law Commission recently concluded that electronic signatures can be used to execute a document, including deeds, and can be witnessed in the same manner as traditional handwritten signatures.

Previously, the HM Registry did not accept electronically signed documents for property transactions, citing the lack of “control of the means of execution used for documents that must be registered, particularly where title guarantee is offered”. After consulting with industry experts, such as E-Sign, HM Registry now feel capable of accepting electronic signatures without compromising security.

Digitalising HM Land Registry Processes with Qualified Electronic Signatures

Whilst we use the generic term ‘electronic signature’, there are three types of electronic/digital signatures:

Simple Electronic Signatures

The most basic form of electronic signature, this can include clicking an ‘I accept’ checkbox or using a scanned handwritten signature.

There are no set requirements for security or identity verification with basic eSignatures. This makes them best suited for use on low value or non-official documents, where there won’t be any legal implications.

Advanced Electronic Signatures

Advanced signatures are required to meet set criteria in order to be legally valid under the eIDAS regulation. This means they must provide a greater level of security, ID verification, and tamper-sealing in addition to being:

- Capable of correctly identifying the signer

- Uniquely linked to the signer

- Created using eSignature data that the signer has complete control over and can be confident that they have the sole ability to sign it

- Linked to the data in a document so that the signer can monitor for further changes

Qualified Electronic Signatures

Qualified eSignatures are the only type of signature to have a special legal status in the EU and hold the same legal status as a handwritten signature.

As well as meeting the requirements for advanced eSignatures, they have to meet additional criteria in order to be issued with a certification.

The identity verification process for these types of signatures is multi-step, using both two-factor authentication and encrypted keys. Qualified signatures must meet the following eIDAS requirements:

- Protect the confidentiality of signature creation data

- Ensure that only one use of the signature is allowed

- Be appropriately protected by the signer

- Ensure the signature is secured against forgery

- Not change the data or prevent it from being presented to the signer before adding their signature

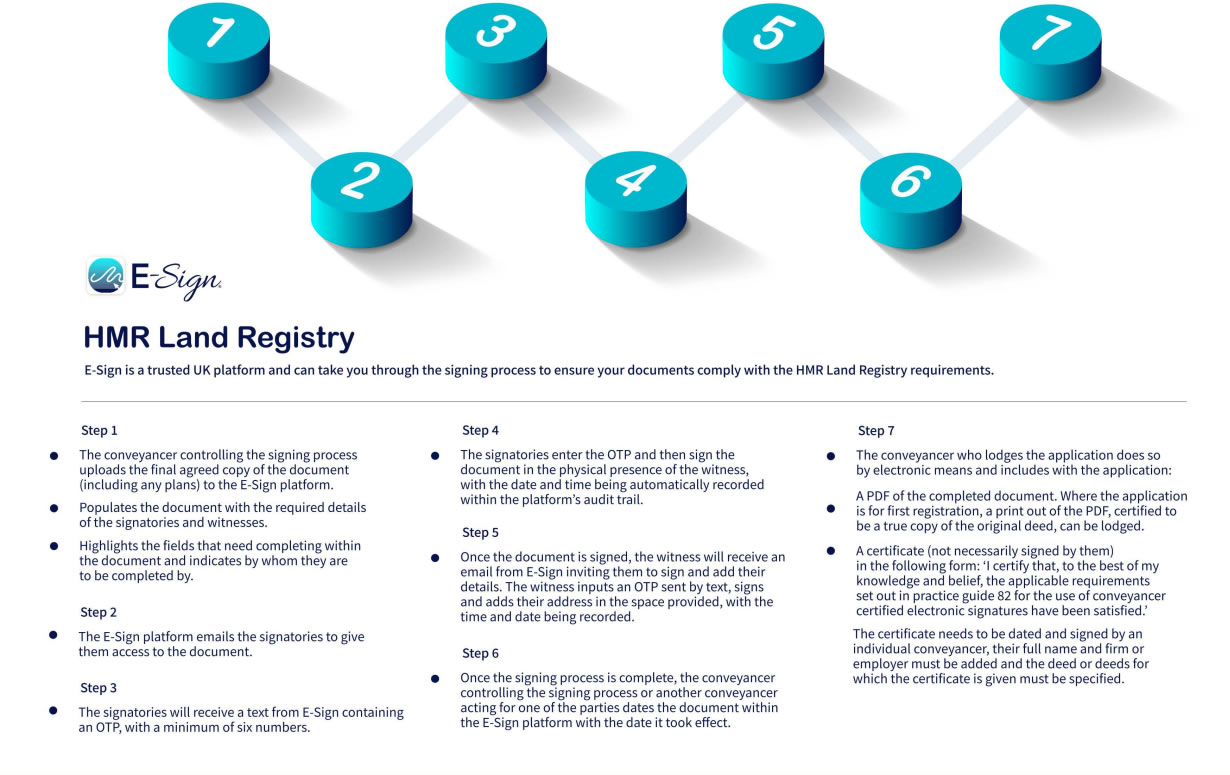

Given their enhanced security and identity verification, HM Land Registry has opted to digitalise their documentation process with Qualified Electronic Signatures (without a witness). They will also now be accepting witnessed electronic signatures in lieu of traditionally signed documents.

Where a witness is required, they would have to witness the digital signing in person, then electronically sign a declaration themselves as confirmation. The time and date of both signatures would be electronically recorded to make sure they’re contemporaneous, helping to verify the witness’s signature.

Cryptographic Biometrics- the Future of Remote Identity Verification?

Whilst Qualified Electronic Signatures can verify the signatories through secure signing and certification, HM Land Registry, the Council for Licensed Conveyancers (CLC) and the Chartered Institute for Legal Executives (CILEx) are now exploring the possibility of cryptographic and biometric identity checks, using microchip-enabled passports or identity cards, a smartphone and an app, similar to the remote identification technology harnessed by the Home Office for the EU Settlement Scheme.

With digital identity checks, the signatory can download an app on their smartphone, which can read the biometric chip and check the validity of the passport. The user will then record a video of their face on the app, which will use facial recognition to match the passport to the holder for near-instant identity verification. This technology would be easy to use and could represent an affordable, remote verification solution for conveyers, providing an additional layer of security for property transactions.

Are E-Sign’s Electronic Signatures HM Land Registry Compliant?

“We need to be sure that not only has a document been signed in a way that would give it proper legal effect, but also that the process was secure and the risk of fraud minimised”-HM Land Registry

Our electronic signatures provide users with a high level of security and identity verification, making them compliant with the HM Land Registry electronic signature legal requirements:

- They are uniquely linked to and capable of identifying the signatory

- They are created in a way that allows the signatory to retain control

- They are linked to the document in a way that any subsequent change of the data is detectable

Beyond this, our electronic signature solution has the following features to minimise the risk of fraud and to create a traceable digital trail:

- Digital Signature Certificate

- IP address recorded

- QR codes unique to individuals & documents

- Unique digital fingerprint generated with each new signature

- Full audit trail

With our secure platform, data encryption and state-of-the-art storage servers, we can provide a compliant electronic signature for the secure digitalisation of property transactions to an industry in much need of modernisation.

How could E-Sign help?

An experienced electronic signature provider, E-Sign has successfully deployed electronic signature solutions across a variety of sectors. E-Sign has previously implemented electronic signatures in a Top 100 Law firm, helping them achieve substantial financial savings and increasing company productivity by digitalising their document signing processes.

By using electronic signatures, the law firm was able to significantly reduce the time spent on document administration, saving approximately 50% of time previously spent on various tasks associated with traditional document processes. Electronic signatures also reduced the turnaround time on document signing from 21 days to just 3, so those important contracts and transactions could be closed within a matter of days, rather than weeks.

Besides streamlining processes and helping the company achieve considerable savings on time, using electronic signatures significantly contributed to an annual financial saving of £284k by reducing company spending on paper, printing, and postage. E-Sign’s electronic signature solution was able to achieve all this without compromising security and legality, demonstrating the ground-breaking potential of electronic signatures in a legal setting.

To find out more about our E-Sign solutions and how they could transform your business, give us a call today on (+44) 0330 057 3001 or email us at info@esign.co.uk

Facebook

Facebook

X (Twitter)

X (Twitter)

LinkedIn

LinkedIn