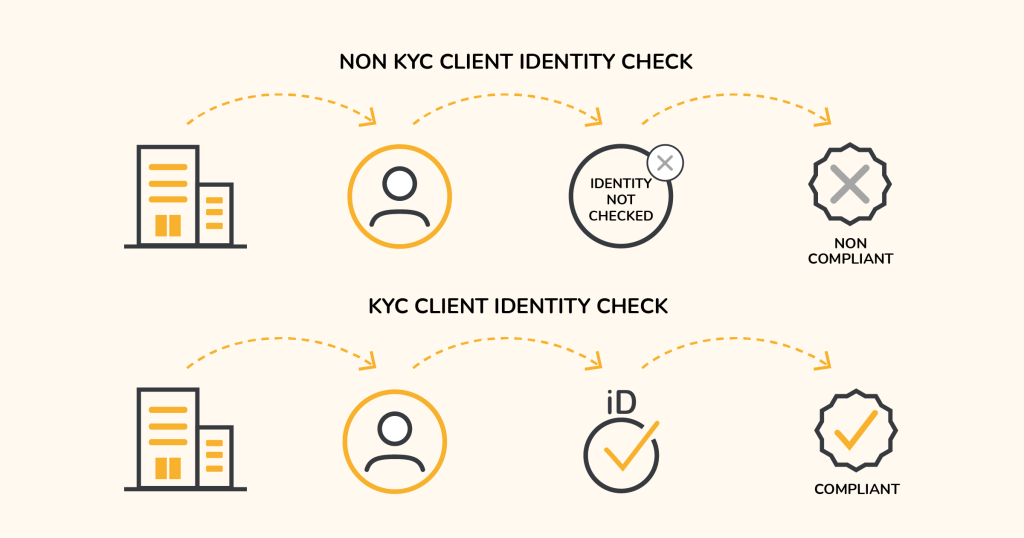

<script type=”application/ld+json”>{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”What is KYC?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”KYC (Know Your Customer) are the steps businesses across multiple industries, including banking, finance, and real estate, must take in order to check and confirm client identities. The Financial Conduct Authority (FCA) introduced this requirement as part of essential money laundering regulations. KYC checks help financial companies confirm that customers are who they claim to be and protect all transactions. “}},{“@type”:”Question”,”name”:”What are KYC checks?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”KYC checks allow companies to assess and verify a customer’s identity, financial activities, and the risk they present to the business. These checks aim to prevent financial crimes like fraud and money laundering. \n\nSuppose a customer does not meet the minimum KYC requirements during the checks. In that case, the company can refuse to do business with them, as they will be doing so, facing a significant risk of crime, fines, and damage to their reputation. It’s important to remember that companies should not perform KYC checks only once. Risk profiles and customer activity can change over time, meaning a financial company should periodically complete due diligence for internal and regulatory use.”}},{“@type”:”Question”,”name”:”What companies are subject to KYC?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”KYC is an important component of Anti-Money Laundering (AML) compliance efforts across several sectors. Businesses in the following industries are required to follow KYC guidelines:\n\nBanks and financial institutions – the finance sector is the main industry that must adhere to KYC because of the large quantities of high-value financial transactions they complete regularly. Any type of money service business must carry out thorough identity verification checks and due diligence on its customers. \nReal estate – when buying or selling property, both parties should have their identities accurately verified as part of KYC to ensure transparency and reduce risk in high-value asset exchanges.\nLegal and professional services – solicitors, accountants, and other professionals involved in property or financial transactions are required to carry out thorough client due diligence. This is essential to prevent the misuse of their services for illicit purposes like money laundering or fraud.\nHigh-value item dealers – luxury goods like art, antiques, and fine jewellery are attractive targets for money laundering. That’s why dealers in high-value items are required to follow strict KYC rules. Verifying customer identities helps prevent criminal activity and protects businesses from legal and reputational risk.”}},{“@type”:”Question”,”name”:”What is the difference between KYC and other regulatory checks?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”KYC is just one example of the checks businesses can carry out to protect themselves and their transactions. Anti-Money Laundering (AML) and Know Your Business (KYB) also exist to assess risk and protect financial institutions from crime. However, there are some key differences among these three processes that businesses should be aware of. \n\nKYC\n\nKYC focuses on individual consumers and verifying their identity. For example, this could be the owner or director of a business. \n\nKYB\n\nKYB aim to verify businesses, which involves confirming the identities of several people. For example, the owner(s) of a company and other relevant parties within it would also undergo a KYC check as part of KYB. \n\nAML\n\nAnti-money laundering checks help to ensure that the business or customer you plan to work with has not been and is not involved in any type of financial crime.”}},{“@type”:”Question”,”name”:”What are the benefits of KYC?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Whilst it may seem complex at first, KYC is a straightforward process and an important way to protect your financial organisation from serious criminal risk. There are several benefits to completing KYC checks, including the below:\n\n \n\nBetter customer experience and increased trust\n\nCompleting KYC checks demonstrates a clear commitment to security that effectively builds trust with customers, reassuring them that their transactions are protected. Additionally, KYC can be streamlined using leading technology, such as advanced analytics and automation, to make the customer experience seamless.\n\n \n\nAvoid financial crime and its repercussions\n\nThis is one of the biggest benefits of KYC. Carrying out your business due diligence and maintaining KYC compliance can help significantly reduce the risk of illegal financial activities affecting your company. Terrorist financing, theft, and money laundering are just a few examples of crimes that cost the UK billions every year. KYC checks are designed to prevent these as much as possible.\n\n\n\n\nRegulation compliance for finance businesses\n\nFinancial businesses must comply with several regulations to ensure they protect their internal and customer data, as well as actively prevent finance-related crimes. KYC checks help businesses adhere to relevant regulations, avoiding any legal repercussions and protecting their brand reputation. Failing to comply with KYC can result in substantial fines and even criminal convictions.\nSaving costs by preventing fraud\n\nImplementing effective KYC checks helps catch fraud and other financial crimes early on. This proactive approach means businesses can avoid costly investigations and the expenses involved in fixing issues caused by illegal activity.\n\n\n\n\nReducing risk with better control\n\nKYC processes give companies the tools to evaluate and manage customer-related risks confidently. By spotting potential threats upfront, businesses can protect themselves from financial losses and minimise exposure to criminal behaviour.”}}]}</script><!–FAQPage Code Generated by https://saijogeorge.com/json-ld-schema-generator/faq/–>